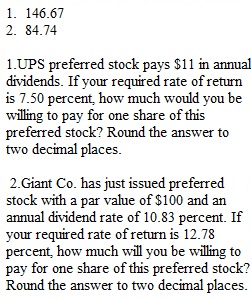

Q 1.UPS preferred stock pays $11 in annual dividends. If your required rate of return is 7.50 percent, how much would you be willing to pay for one share of this preferred stock? Round the answer to two decimal places. 2.Giant Co. has just issued preferred stock with a par value of $100 and an annual dividend rate of 10.83 percent. If your required rate of return is 12.78 percent, how much will you be willing to pay for one share of this preferred stock? Round the answer to two decimal places. 3.Golden Rod Corp.'s preferred stock is currently selling for $42.59. The company pays $7.96 annual dividends on this preferred stock. Which rate of return does the investor expect to receive on this stock if the stock is purchased today? Round the answer to two decimal places in percentage form. (Write the percentage sign in the "units" box) 4.Potter’s Violin Co. has just issued nonconvertible preferred stock with a par value of $100 and an annual dividend rate of 17.58 percent. The preferred stock is currently selling for $143.48 per share. Which rate of return does the investor expect to receive on this stock if the stock is purchased today? Round the answer to two decimal places in percentage form. (Write the percentage sign in the "units" box)

View Related Questions